The Rise of Microbrand Watches: How Independent Brands Are Revolutionizing the Watch Industry

The Rise of Microbrand Watches: How Independent Brands Are Revolutionizing the Watch Industry

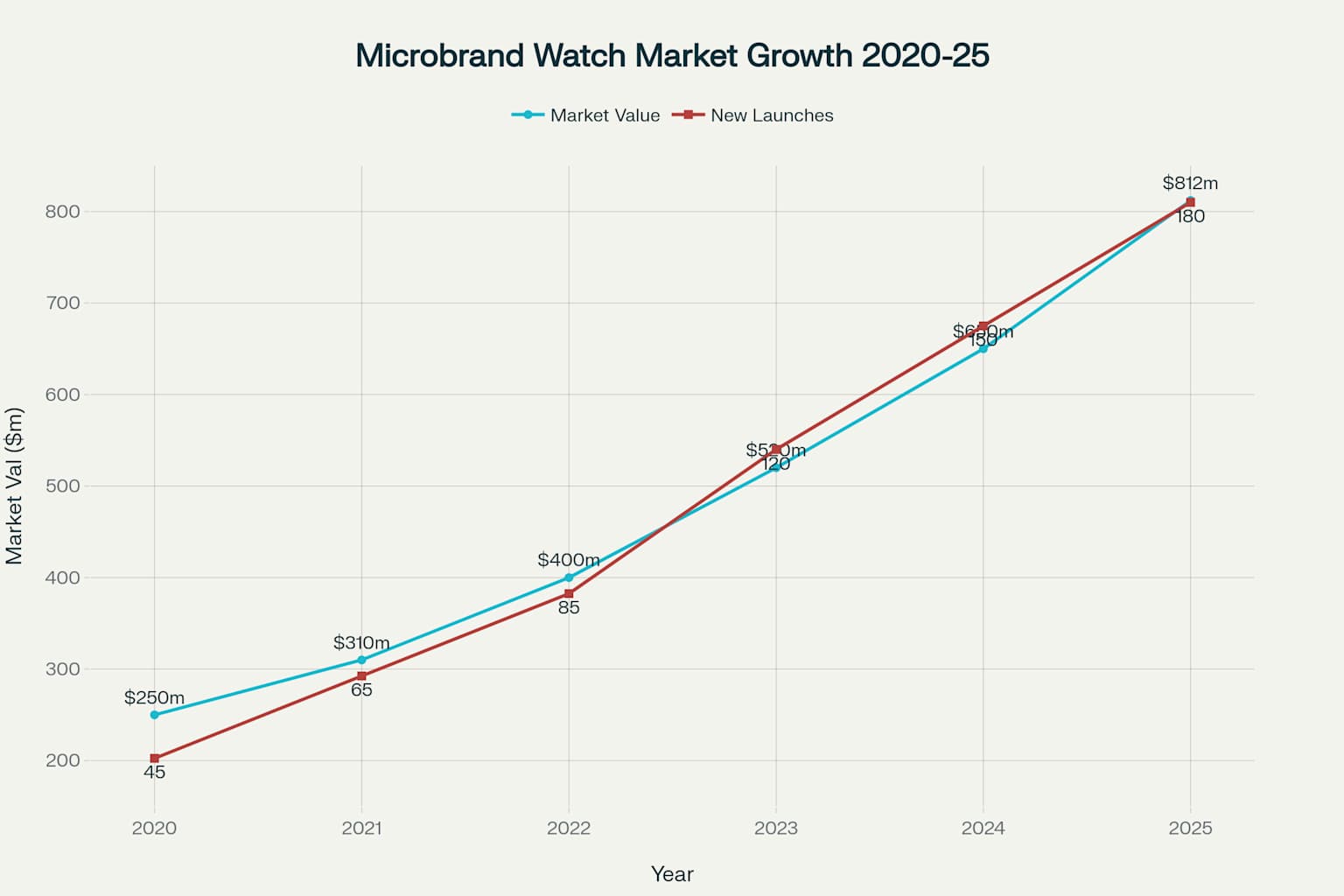

The watch industry, long dominated by Swiss giants and luxury conglomerates, is experiencing a seismic shift that's reshaping how consumers think about luxury timepieces. Microbrand watches are emerging as the David to the industry's Goliaths, offering compelling alternatives that combine quality craftsmanship with accessible pricing.Industry analysts project that the microbrand watch sector will grow by 25% over the next five years, driven by an increasing number of collectors and fashion-forward consumers seeking distinctiveness in their wristwear.

The microbrand phenomenon represents more than just a market trend—it signals a fundamental democratization of luxury watchmaking. These small, independent companies are leveraging direct-to-consumer sales models and digital marketing to challenge traditional retail paradigms. With over 100 new microbrands launching globally in the past year alone, this segment is rapidly becoming a force that established brands can no longer ignore.

What Defines Microbrand Watches?

Microbrand watches represent a new paradigm in horology—small, independently-owned watch companies that typically produce 200-300 watches annually, sometimes fewer. These brands are characterized by several key attributes that distinguish them from traditional manufacturers.

The defining characteristics include independent ownership by a single person or small team, limited production runs ensuring exclusivity, and direct-to-consumer sales primarily through online channels. Most microbrands outsource manufacturing of components to established suppliers while maintaining community-driven approaches with close customer relationships.

Unlike traditional luxury brands that mark up their products by 30 times or more, microbrand watches typically apply a maximum three-times markup, passing substantial savings to consumers without compromising quality. This pricing strategy has become a cornerstone of the microbrand value proposition.

The Market Explosion: Unprecedented Growth in Numbers

The microbrand watch market has experienced unprecedented growth, with market analysts tracking remarkable expansion across multiple metrics. Sales of microbrand watches have seen notable increases, particularly in markets like the United States, Europe, and parts of Asia.

The appeal lies in their limited production runs, which guarantee exclusivity while maintaining accessible price points typically ranging from $200 to $2,000. This democratization of luxury has attracted a new generation of collectors who value authenticity and craftsmanship over traditional brand prestige.

New players are continually entering the market, with over 100 new microbrands launching globally in the past year alone. These brands are quickly gaining footholds by focusing on niche markets, such as watches made specifically for adventurers, divers, or those with specific historical themes.

Leading Microbrand Success Stories

Christopher Ward: The Pioneer of Direct-to-Consumer Luxury

Founded in 2005 in a converted chicken shed in Berkshire, Christopher Ward became the world's first online-only watch brand. The company's revolutionary approach included direct-to-consumer sales exclusively through their website, maximum three-times markup on manufacturing costs, and avoidance of expensive celebrity endorsements.

Christopher Ward's breakthrough came when a respected watch collector wrote a glowing review on TimeZone.com, describing their C5 Malvern as "the best-value mechanical watch the world had ever known". This grassroots endorsement sparked international interest and established the template for microbrand watch marketing.

Today, Christopher Ward generates over £100 million in annual revenue and has won prestigious awards including recognition at the GPHG watch awards in Geneva, competing alongside Audemars Piguet and Piaget. The brand's success demonstrates how microbrands can achieve mainstream recognition while maintaining their core values.

Baltic: French Elegance Meets Global Appeal

Baltic Watches, founded by Etienne Malec in 2017, exemplifies the personal storytelling that drives microbrand success. Inspired by his late father's watch collection and meticulous notes, Malec created a brand that celebrates neo-vintage designs with modern quality.

Baltic's direct-to-consumer model removes traditional retail markups, allowing them to offer Swiss-movement watches with French assembly at competitive prices. Their Aquascaphe collection has become particularly popular among enthusiasts seeking vintage diver aesthetics.

The brand operates primarily through a direct-to-consumer e-commerce model, shipping its timepieces to customers worldwide from France. This global reach is supported by international marketing efforts and active engagement on social media platforms with thriving communities on Facebook and Instagram.

Zelos: Innovation Through Materials and Crowdfunding

Singapore-based Zelos Watches, founded in 2014, demonstrates how microbrands leverage cutting-edge materials and innovative funding approaches. The brand has successfully crowdfunded multiple collections, with the Helmsman, Chroma, and Abyss achieving 273%, 350%, and 650% of their funding targets respectively.

Zelos distinguishes itself through unconventional material choices including bronze cases, meteorite dials, and forged carbon, proving that microbrand watches can push boundaries that established brands might consider too risky. The brand's willingness to experiment with materials like bronze, which develops unique patina over time, has attracted collectors seeking distinctive timepieces.

The Digital-First Advantage

Microbrand watches thrive in the digital age by leveraging technology and platforms that traditional brands have been slow to adopt. Social media platforms serve as primary showcase venues, with Instagram functioning as a visual catalog and Facebook communities providing direct customer feedback.

Independent YouTube reviews by enthusiasts drive credibility in ways that traditional advertising cannot match.Crowdfunding platforms like Kickstarter validate market demand before production, reducing financial risk while building community engagement.

Successful microbrands maintain unprecedented proximity to their customers, with many founders personally responding to emails and participating in online forums. This level of engagement creates loyalty that transcends typical brand-customer relationships.

Without bureaucratic layers, microbrand watches can rapidly iterate designs based on real-time market feedback.Social media platforms function as continuous focus groups, allowing brands to test concepts and refine products before production.

Quality Without Compromise

A common misconception is that affordable microbrand watches sacrifice quality for price. The reality demonstrates that microbrands often use the same high-quality components as luxury brands while maintaining more accessible pricing.

Most reputable microbrands use proven Swiss movements from suppliers like ETA, Sellita, and La Joux Perret—the same movements found in watches costing thousands more from traditional brands. Many microbrands manufacture cases and components in Swiss, German, or French facilities, maintaining traditional quality standards while optimizing costs through direct relationships.

Limited production allows for enhanced quality control, with many microbrand founders personally inspecting every watch before shipment. This hands-on approach often results in better quality control than mass-produced alternatives.

Investment Potential and Market Recognition

While microbrand watches rarely achieve the investment appreciation of Rolex or Patek Philippe, certain models have demonstrated collectible potential. Successful crowdfunding campaigns often create instant collectibles, with Unimatic's NASA collaboration and SpongeBob SquarePants editions now trading for multiples of their original retail prices.

Early pieces from brands that achieve mainstream success can appreciate significantly. Christopher Ward's original C5 Malvern, once available for under £200, now commands premium prices on the secondary market.

The Time Bum's 2024 Microbrand Watch of the Year award went to the Prevail Onward Future Field Watch, demonstrating that microbrands are gaining recognition from established watch publications. Such recognition helps validate the quality and innovation that microbrands bring to the industry.

Challenges Facing the Microbrand Sector

Despite their success, microbrand watches face inherent limitations that traditional brands don't encounter. Brand recognition remains a significant challenge, as microbrands struggle for mainstream recognition outside enthusiast communities.

Direct-to-consumer models limit physical retail presence, making it difficult for customers to examine watches before purchase. This creates a barrier for consumers who prefer hands-on evaluation before making purchasing decisions.

Scaling difficulties present another challenge, as rapid growth can strain the personal touch and community engagement that initially drove success. Supply chain vulnerabilities also pose risks, as dependence on external suppliers makes microbrands vulnerable to disruptions and quality inconsistencies.

The Future of Microbrand Watches

Industry trends suggest continued growth for microbrand watches across multiple dimensions. Technology integration represents a key opportunity, with emerging microbrands increasingly incorporating smart features while maintaining mechanical aesthetics.

Environmental consciousness drives microbrand innovation in materials and manufacturing processes, positioning them advantageously with younger consumers who prioritize sustainability. Digital marketing capabilities allow microbrands to reach international markets without traditional distribution overhead, democratizing global access to quality timepieces.

The most successful microbrands will likely evolve from product companies to lifestyle communities, creating ecosystems around shared values and aesthetics. This community-building approach aligns with broader consumer preferences for authentic brand relationships.

Making the Microbrand Choice: A Buyer's Guide

For consumers considering microbrand watches, several factors merit careful evaluation. Researching the founder's background and commitment provides insight into long-term viability and values alignment.

Examining movement specifications and verifying that movements come from reputable suppliers ensures quality comparable to traditional brands. Active social media presence and responsive customer service indicate healthy brand-customer relationships that enhance the ownership experience.

While not typically investment pieces, some microbrands maintain better resale value than others based on reputation and rarity. Understanding these factors helps inform purchasing decisions for both daily wear and collection purposes.

Conclusion: A New Chapter in Horological History

The rise of microbrand watches represents more than a market trend—it signals a fundamental shift toward authenticity, accessibility, and community in luxury goods. As traditional brands grapple with changing consumer preferences, microbrands offer compelling alternatives that prioritize value, innovation, and personal connection over heritage and status.

For watch enthusiasts, the microbrand phenomenon provides unprecedented access to quality timepieces that reflect individual taste rather than conforming to established luxury conventions. Whether seeking a daily wearer or adding diversity to a collection, microbrand watches deserve serious consideration for their unique combination of quality, value, and character.

The future likely belongs to brands that can successfully balance the intimacy and agility that makes microbrands special with the scale and recognition that drives broader market success. As this evolution continues, watch enthusiasts will benefit from increased choice, better value, and more meaningful connections to the timepieces they wear.

Ready to explore microbrand watches? Research established brands like Christopher Ward, Baltic, and Zelos to understand what makes these independent watchmakers special. Join online communities, read reviews, and consider attending watch shows where you can experience microbrands firsthand before making your first purchase.

Leave a comment